Electronic Payment System for Global Fintech Market

An e-payment system affiliated to the largest banking network, allowing near-instant, secure transactions across national borders. Localized for language and currency. No cash, credit cards or personally identifying information.

Connecting merchants to consumers, businesses to businesses

An electronic payment system for online shopping used by Adidas, Reebok and Uber. Consumers can purchase in their own currencies without risking personal or financial information. Businesses can transact rapidly, securely and inexpensively.

Delivered to the client as a multi-component electronic payment system with integrations including APIs for banks, databases and tertiary services, SAP integration, and a web app for payment management and control.

Introducing e-Payment systems

The e-payment system does not require any personal or financial data to function, providing protection against identity theft, chargeback and fraud.

Used by:

monthly transactions

response time

emails & SMS monthly

banks

cash collection points

countries

Integrated with:

Funds are securely settled, and the technology platform guarantees scalability, reliability, efficiency and security.

Payment challenges: insecure, inconvenient, expensive and slow

The payments space typically offers users unintegrated tools that require sensitive information to function, charge high fees and take too long to process transactions. The space suffers from:

There was a clear market need for an electronic payment system that was the opposite: easy to use, low-cost, rapid and secure.

Creating an e-Payment system

Electronic Payment system solves the major problems with the space, delivering a seamless, intuitive experience that’s consumer-friendly and backed by a suite of communication, security and privacy features that support business use.

Backend

ASP.NET (WebForms, WebAPI, MVC, Core), Identity Server Core, OAuth2, SOAP Web Services, Windows services, SignalR, Redis, Quartz, Topshelf, TCP sockets, Dapper, Entity Framework, IoC (Autofac, Simple Injector), SSRS, SSIS

Database

MS SQL Server

Frontend

Knockout, Angular

Results

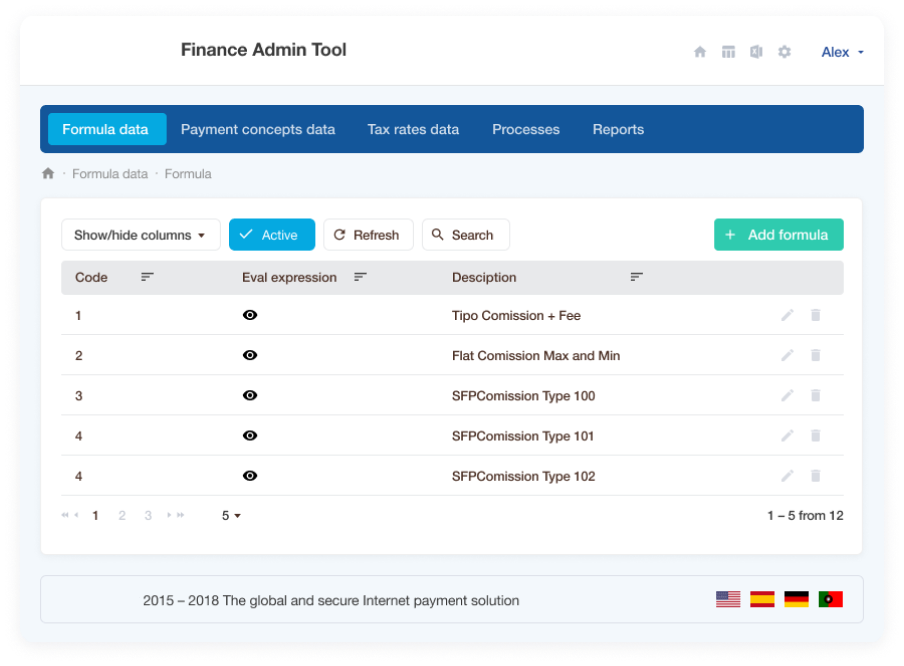

Electronic Payment system was delivered to the client as a multi-component, multi-integration tool including web app and APIs for banks, databases and third-party services. Currency conversions, commission calculations and account payments to customers are included and the product is integrated with SAP, allowing for automated workflows that reduce human labor and potential error.

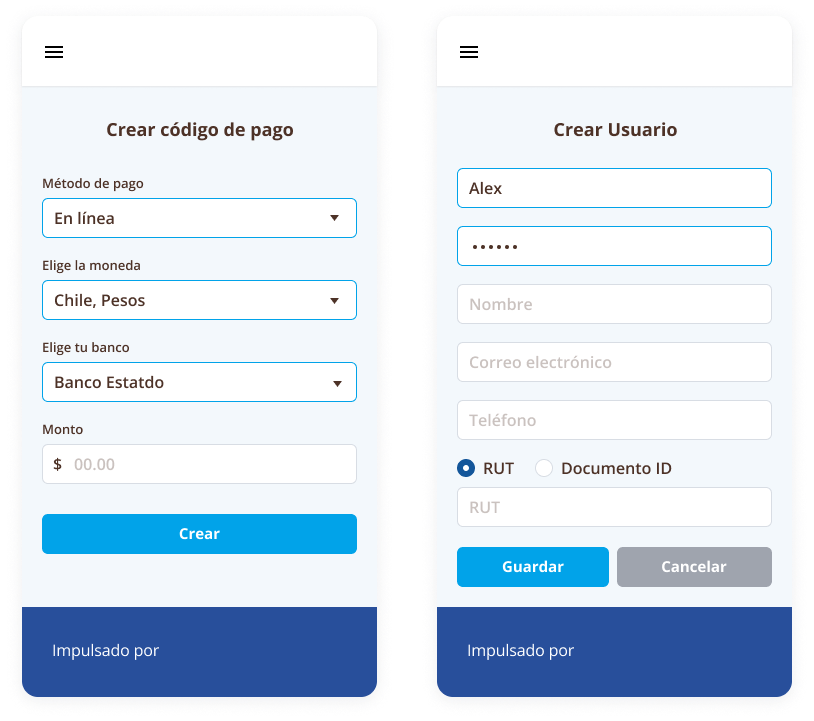

Users can:

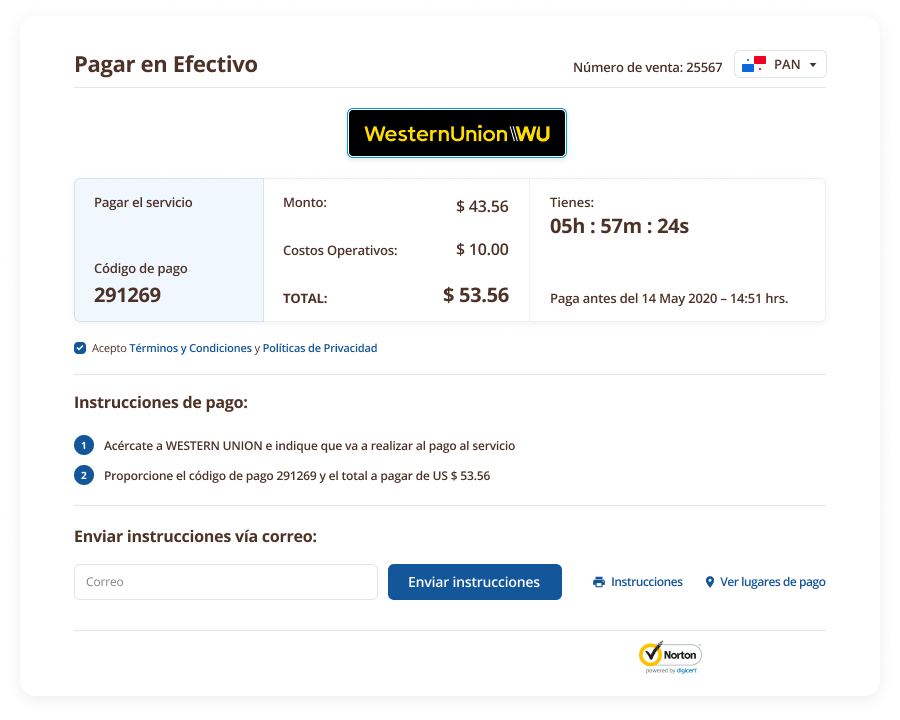

- Receive bank transfers

- Collect cash payments

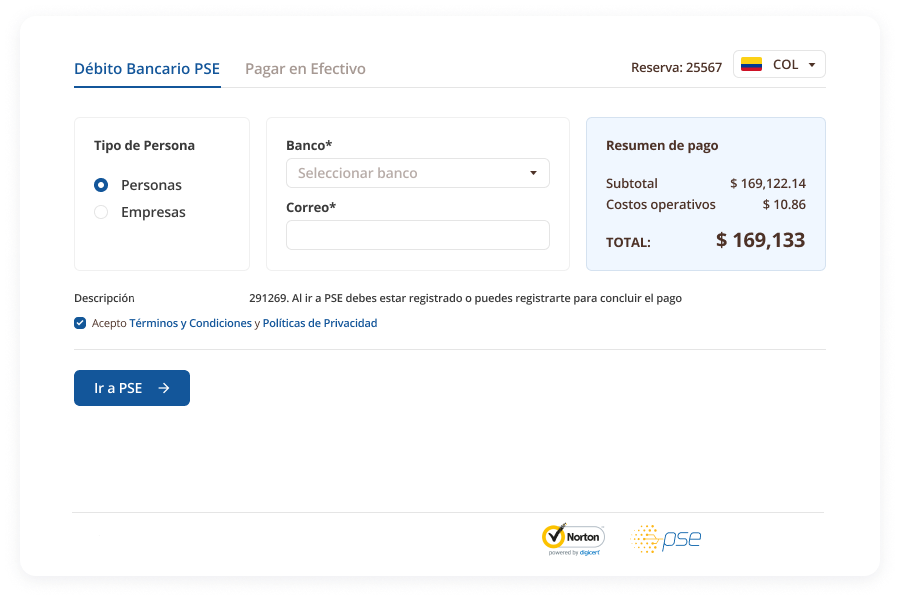

- Enable other non-card local payment methods

- Receive real-time confirmation

- Achieve reconciliation

- 0% fraud or chargebacks

- Access e-Payment system with a single integration

- Get access to the e-Payment system Payment Network with a single integration